The Marketing In Manufacturing Report 2022

Welcome to the second edition of the Annual Marketing In Manufacturing Report, researched and delivered by Intergage in partnership with The Manufacturer.

In 2021/22, manufacturing continued to act as the backbone of the UK – despite the ever-increasing challenges surrounding Brexit, Covid-19 and the growing talent gap. Supply chains have been under more pressure than ever before with raw material costs at an all-time high, matched with a shortage in raw materials for many. On top of this, surging oil and gas prices have and will continue to make running manufacturing businesses more expensive. In fact, IBIS World predicts this alone will cost manufacturers £8.7 billion in 2022.

However, the outlook is still positive, and manufacturers continue to innovate with 40% investing in sustainable manufacturing, 68% improving supply chain resilience and 54% accelerating new product innovation. Innovation in supply chain resilience has also increased by 24% (Fictiv).

Yet again, digital marketing has been part of that innovation, making it easier for manufacturers to align sales and marketing teams, increase efficiency and grow their businesses. There are certainly still challenges to overcome but, generally speaking, manufacturers value marketing and plan to continue investing in digital tools to feed their sales and marketing production lines.

This report will cover how budgets have changed in the last year, what marketing initiatives manufacturers plan to invest in across the next 12 months and how industrial businesses will continue to meet their objectives using digital marketing.

Manufacturer Attitudes Towards Marketing

While the industrial sector certainly values marketing, it does seem to have become less of a priority since last year. In 2021, 63% of manufacturers rated marketing as a high priority, compared with just 49% in 2022. Could this be as a result of the myriad of challenges manufacturers face when it comes to supply chain, raw materials and accessing talent? Has there been a switch in focus to keep the wheels moving instead of looking for new business?

.png?width=1200&name=Survey%20report%20charts%202022%20(12).png)

This would be a huge mistake and one that would cost manufacturers greatly. While putting a pause on marketing may be tempting to some, it will hinder growth in 6-12 months’ time. That may feel like a problem for the future business but it matters. The time to remain competitive and get in front of prospects is now.

When the data is split by job function, it’s clear to see that most business leader respondents (64%) feel that marketing is a high priority compared with just 33% of salespeople. The idea that marketing is less of a priority is felt by marketers themselves – last year 64% of marketers surveyed felt marketing was a high priority. This year that sits at just 47% – a decrease in confidence of 17 basis points.

.png?width=1200&name=Survey%20report%20charts%202022%20(13).png)

Does this indicate an industry that likes to think it prioritises marketing but doesn’t follow through? Are marketers struggling to prove the efficacy of marketing to salespeople? It’s difficult to tell why the separate groups are so disparate but there is clearly a misalignment – making marketers feel their efforts are somewhat underappreciated.

When asked what their three most significant marketing challenges were, respondents highlighted the following:

- creating enough high-quality content

- targeting the right audience

- measuring success and return on investment

- not having the relevant skills or internal resources.

It’s a very similar picture to that of the year before. Manufacturers are clearly still struggling to place efforts in the right areas and measure success as a result. A lack of content creation resource is clearly an issue for manufacturing businesses, despite being a priority for many for the next 12 months.

Marketers in manufacturing have embraced content marketing for some time now. Using irresistible content to attract and engage prospects is a winning strategy in today’s world dominated by empowered buyers. (Well-informed B2B buyers don’t want to be ‘sold to’ – they want to engage on their own terms.)

But generating all that content is another matter entirely. It’s hard work – as 49% of respondents confirmed in the survey. According to the CMI’s report, 60% of manufacturers have a small or one-person marketing team servicing the entire organisation. That’s a lot of content for a small team to create, especially when considering the multitude of content types to cover. According to a study by engineering.com, manufacturers invest in creating video, white papers, ebooks, blogs, case studies and more. It’s highly unlikely that a small team of marketers holds all the skills to create such content, let alone a one-person marketing team. Unsurprisingly then, 61% of industrial marketers outsource at least one content marketing activity (CMI).

Aside from all the work involved, there are other challenges too:

- ensuring your important content ‘pillar’ pages and associated ‘topic cluster’ blog posts are targeting the right keywords

- ensuring your efforts are not undermined by a slow, cumbersome and unappealing website that search engines downgrade and users dislike

- sharing the content so it is seen – social media algorithms are making it harder for content to be seen organically. (44% of respondents said targeting the right audience was a challenge.)

Again, there is the recurring issue of measuring success and ROI (41%). Experience tells us that figure should really be higher. This is because many companies believe they’re measuring marketing ROI well…but in reality, they're not. The 44% figure is an increase on last year’s report which revealed that 33% of marketers struggled to measure return on investment – it appears to be an ever-increasing challenge.

Add to that the fact that:

- 39% don’t have the right skills or internal resources

- 12% don’t know which marketing technology they should be using.

It all adds up to a significant knowledge gap between where manufacturers are now with their marketing and where they need to be to remain competitive in a rapidly changing world. Upgrading marketing technology could help businesses to overcome challenges such as measuring success, creating enough high-quality content and targeting the right audience. Investing in great marketing software such as HubSpot provides marketers with a single source of truth, easy data segmentation and the ability to become more efficient by automating tasks.

What Marketing Activities Are Manufacturers Using?

According to the Fictiv 2021 State of Manufacturing Report, 91% of manufacturers increased their digital transformation efforts over the past year.

If digital transformation were ever a hum in the background of manufacturing operations and production, Covid-19 brought it roaring to the fore, spurred by the need to increase manufacturing resilience, agility and product innovation, as well as to adapt for remote and flexible work processes.

In 2022, digital transformation isn’t just the hallmark of a pioneering business that wants to spearhead growth and innovation. With so many manufacturers making digital transformation a priority, it has fast become a benchmark of competence. Digital must be adopted and absorbed into manufacturing processes, lest your company be left behind.

So, where does marketing activity come in?

With digital fully embraced in the context of manufacturing operations and production, are marketing efforts graced with the same innovation? And more importantly, are they getting results?

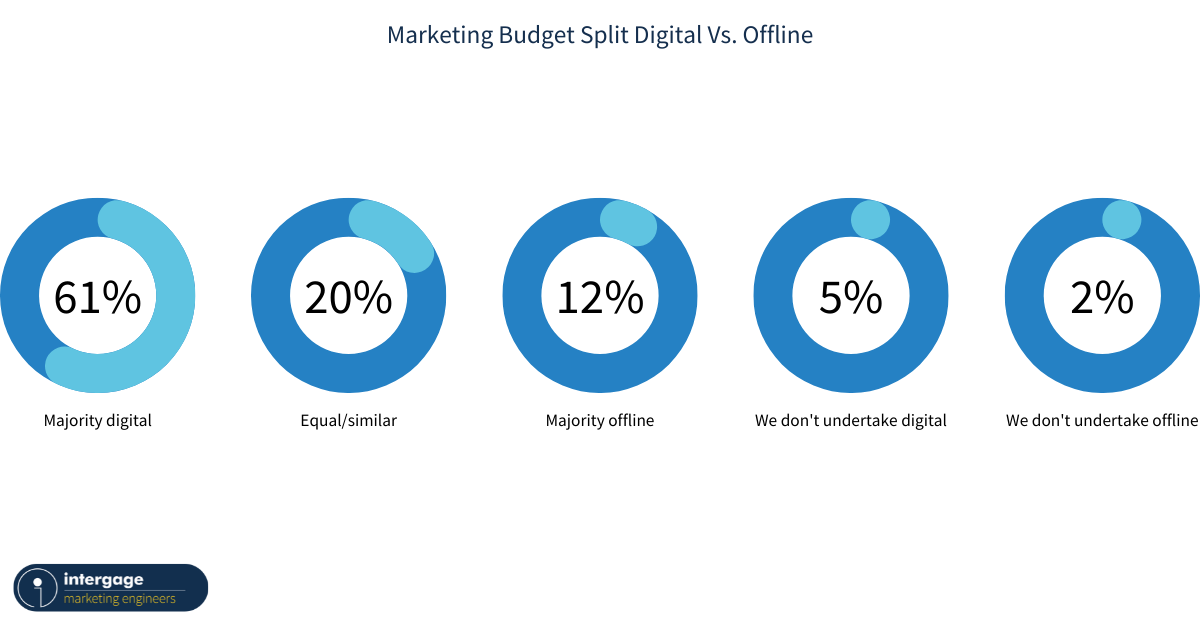

Our report found that 61% of respondents were steering their marketing budget towards a mostly digital output. Only 12% were pushing their spend into mostly offline activity, while a mere 5% of respondents said they didn’t pursue digital marketing at all.

It’s clear that offline marketing is providing a supporting role at most. Meanwhile, digital infiltrates almost every element of the manufacturing effort, from the sales lead to the production line.

So, we know that digital is where marketing teams are investing most of their budget – but what activities does it fund, exactly?

In the top spot is organic social media promotion (95%), which – given that more than 70% of today's millennials are B2B buyers – is no surprise. CMI also found that LinkedIn continues to be the organic social media platform that manufacturing marketers use the most (87%).

This tech-savvy segment of your customer base will be researching your company on a variety of online channels, so it’s vital to make sure you are visible. Some 57% of manufacturers surveyed by the CMI said they had put more resources toward social media/online communities, in an attempt to grab the attention of potential customers who hang out in those spaces. Better yet, it’s possible to implement a basic social strategy with little-to-no upfront cost (aside from the hours spent curating content, of course).

However, not everything in life is free – 64% of our respondents’ marketing activity was spent leveraging paid digital ads. That’s a 23% increase on last year’s report, suggesting that manufacturers are becoming wise to the benefits of paid advertising.

The Thomas Industrial Survey found that, after the pandemic began, 45% of respondents claimed digital advertising (such as search and social media) was an important avenue to reach new customers – a significant rise from 31% before the pandemic began. It’s entirely probable that the restrictions on

in-person events, as well as the rise in remote working, has encouraged manufacturers to take advantage of digital channels where their customers are more likely to have a consistent presence.

It's worth noting however, that Google PPC was more expensive last year. Cost per conversion went up for many players with the possibility that many costly conversions were simply cannibalising organic traffic – users and sessions you would have attained for free if you weren’t advertising. That said, strategies such as PPC are more predictable.

Furthermore, your social and paid digital strategies need more than just a platform and a budget. In order for either of these channels to take off for your marketing, they need to be fuelled by helpful content.

It is, therefore, very reassuring to see that 59% of marketing activity carried out in the last 12 months was dedicated to creating regular, written website content – from blogs and case studies to white papers and industry reports (just like this one).

We really can’t over-emphasise the importance of creating useful content that your audience will want to engage with. It’s absolutely key to your entire marketing ecosystem and the results are well-founded. According to research by ABG Essentials, content marketing provides conversion rates about six times higher than other digital marketing methods. Better yet, inbound marketers are able to double the average site conversion rate (from 6 to 12%), in part due to their content marketing efforts.

You don’t need to be an engineer to figure out that this is the kind of maths we like.

Video is also a crucial part of any marketing campaign. B2B buyers are consuming an increasing amount of video – and studies show that they retain more information from watching a video than from reading text! One study found that viewers retain up to 95% of information from a video while only retaining around 10% of the same information in text format (Invisia). As a result, including video in a campaign can lead to average conversion rate increases of 34% (Aberdeen Group).

Of course, there are only so many hours in a day and even the most enthusiastic marketer will struggle to hit every channel available to them. However, it’s surprising to see that marketing automation represented a mere 12% of our respondents’ marketing activity.

Automation is hugely beneficial, allowing efforts to be streamlined so you can spend more time focussing on the bigger picture, as well as getting laser-sharp results from your marketing efforts day-to-day.

Automation can help you to:

- generate and nurture leads through the sales funnel

- track whom to target and when

- reduce churn by creating customer service touchpoints

- schedule social media posts

- answer your customers’ questions via live chat (or chatbots, to save customer service time)

…and much more.

So, why doesn’t it have a bigger presence in the manufacturing space? More than half of the companies surveyed by Thomas reported that they met or exceeded the industry standard for automation, with 55% of the participants being likely to very likely to invest in Production Performance Automation in the next 12 months. However, adoption of automation in the marketing department is far slower.

This can, perhaps, be attributed to skills gaps and the perceived complexity of marketing automation software: 45% of manufacturers name budget limitations as a key barrier to hiring new innovation talent, while manufacturing companies are cited to be most interested in filling vacant positions in general factory labour, machine operators and engineering.

By taking the manpower out of marketing tasks, smaller businesses have an opportunity to keep up with those that operate on a much larger scale. Smaller businesses can achieve this by recruiting innovative marketing talent or by choosing to work with a marketing agency that specialises in automation.

It’s no great surprise to see that patterns of success in marketing are following the tactics used. You aren’t likely to see a payoff if you aren’t offering any kind of investment, after all.

However, some may find it unusual that only 29% of our respondents’ marketing success came from written content creation, and just 14% from creative content (such as videos and infographics). Didn’t we just say how important content creation was?

Well, it’s still true. What’s also true is that it isn’t a quick win.

According to Lyfe Marketing, 78% of consumers prefer getting to know a company through content rather than traditional advertising. Nevertheless, creating content is a long game. It needs to be thoroughly researched and purposefully crafted, which undeniably takes time.

You’re unlikely to write a blog post today and get five new leads tomorrow, but if the content is evergreen and will stay relevant for a long time, it could dutifully serve you with website clicks for years to come. What matters is getting it off the ground in the first place, so you can start to yield those results – and it’s likely to require some help, either from a marketer in-house, or from an agency that can give you access to creative talent.

Once you’re loaded up with content, it’ll turbo-power your social media, digital advertising, SEO and email marketing – propelling you towards further success.

Activity at exhibitions (17%), networking at sector-specific organisations (14%) and speaking at events (10%) imply that in-person activity didn’t return to form in 2021.

When it comes to mingling with other industry professionals, webinars are becoming increasingly significant – even in a post-pandemic world. The Content Marketing Institute says that manufacturers using “virtual events/webinars/online courses” have increased to 55% from 39%.

Trends imply that – even when in-person events are back on the table – convenience and confidence in technology will mean that virtual offerings are here to stay.

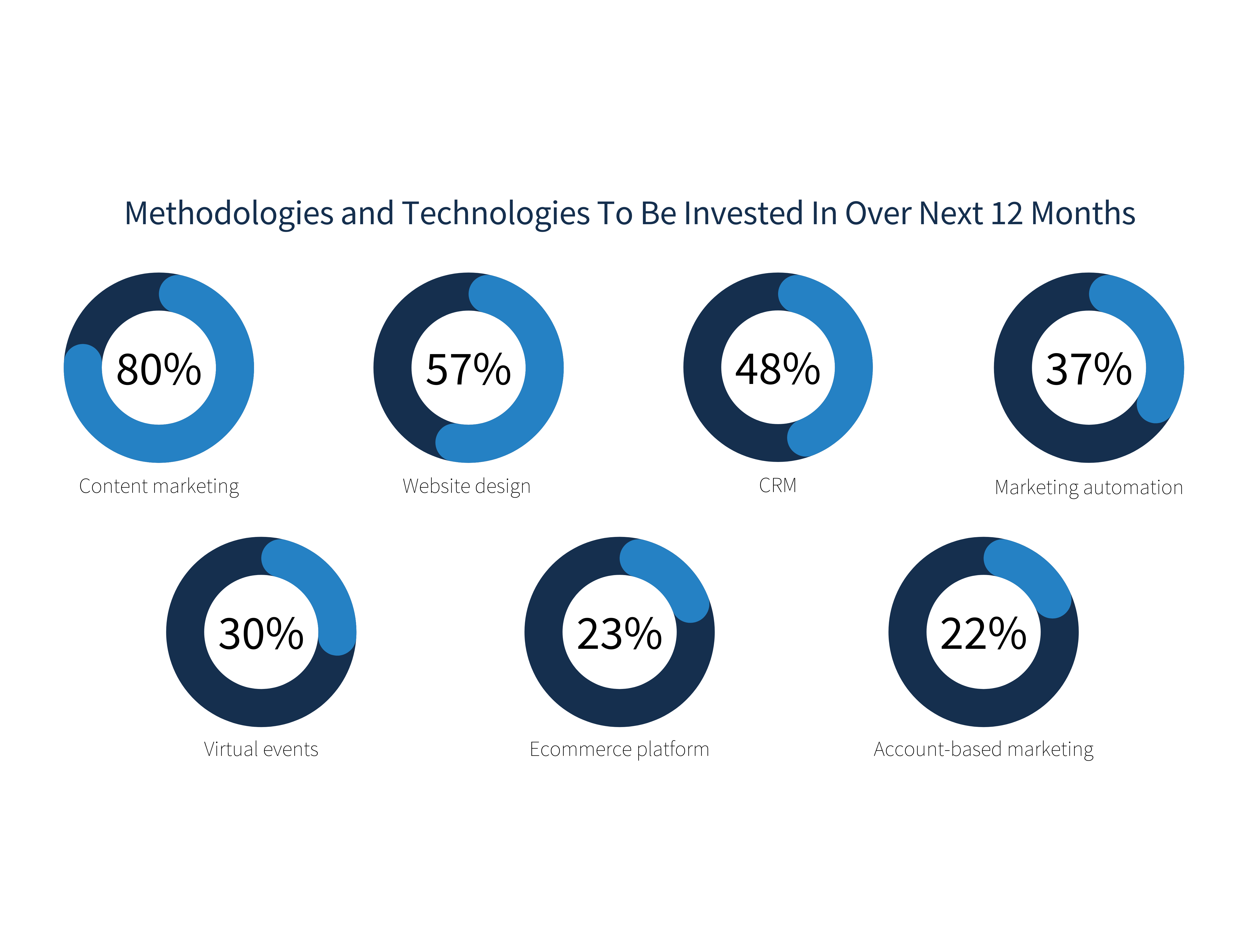

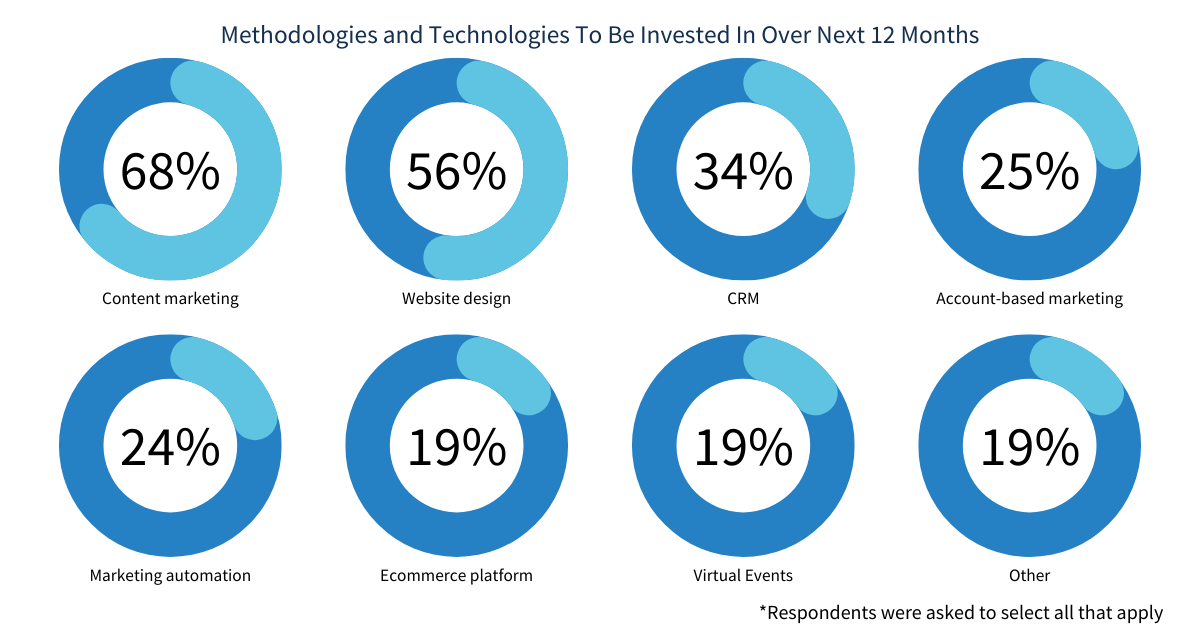

With content marketing at the core of so much potential success, it’s great to see that – over the next 12 months – our respondents are planning to commit the lion’s share of their investment into this area.

This emphasis is mirrored across the majority of industries around the world. According to HubSpot, 70% of companies globally are investing in content marketing.

The wind isn’t likely to change direction anytime soon. The rapid acceleration of digital marketing in the industry may have been triggered by the limitations of Covid-19 but the gains are far from temporary, with future investments indicative of long-term digital strategies.

With more and more manufacturers competing to have their voices heard in a digital space, it’s vital not to be drowned out by the noise.

Now is the time to build your online presence and be sure you’re the one your audience is listening to.

What Do Manufacturing Marketing Budgets Look Like?

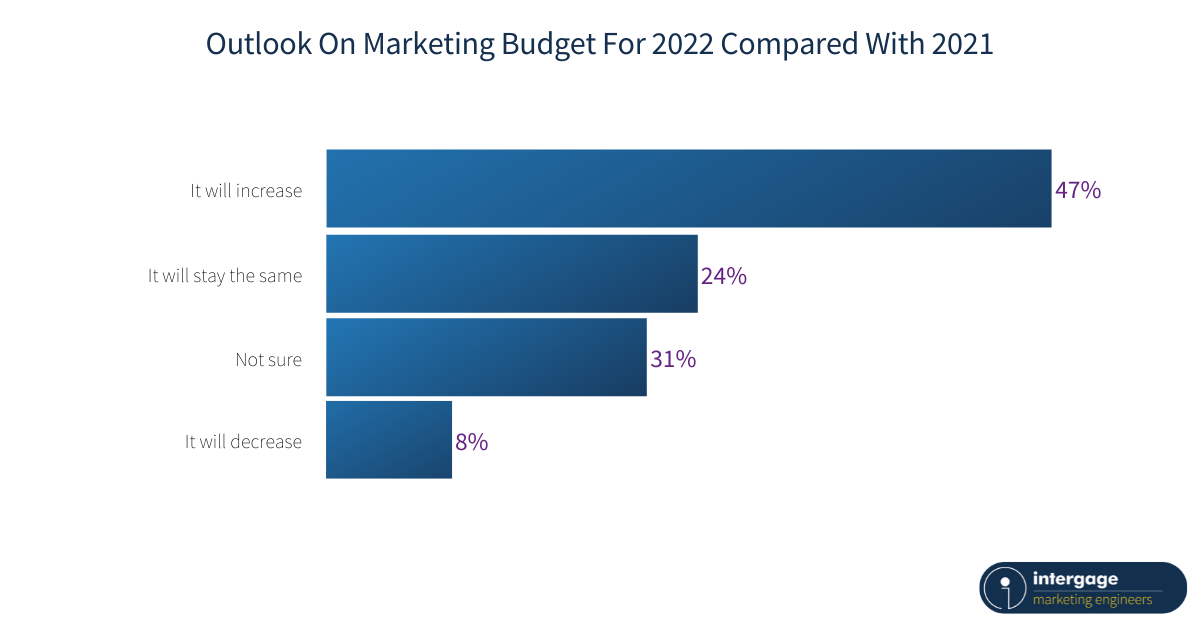

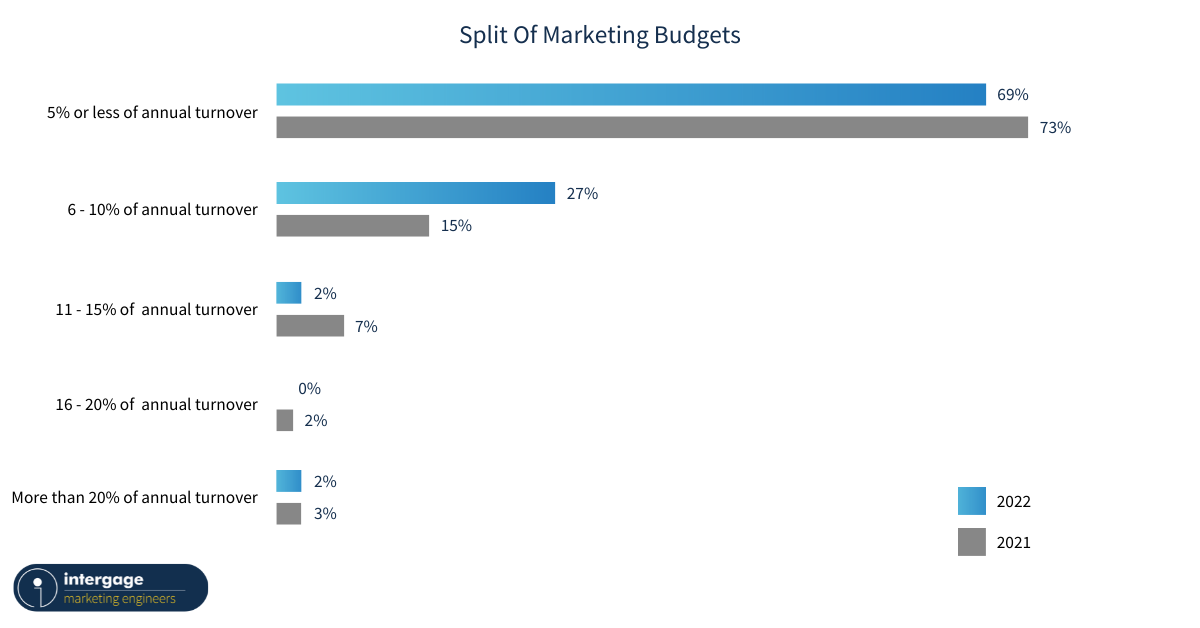

The 2021 Marketing In Manufacturing Report revealed that most manufacturers planned to maintain or increase their marketing spend in 2022 (79%). Many of those previously spending 5% or less of annual turnover now spend an average of 6-10% of annual turnover. That said, fewer are spending in the 11-20%+ brackets, indicating that bigger spenders have reduced their marketing budgets.

This isn’t entirely surprising with manufacturers facing new costs associated with Brexit. Meeting new legislation, disruption of EU-UK trade, increasing material costs and reduced access to labour have all hit UK manufacturers’ bottom lines. In fact, 66% of manufacturers stated that the end of the transition period has hampered their business (Make UK).

Reduced labour and access to raw materials has also made it incredibly difficult for manufacturers to meet the demands they already have. It can be difficult to comprehend generating more leads when you’re struggling to service the projects already in the pipeline.

However, dialing back on marketing is not a smart move for the long-term. Manufacturers should continue investing to build their brands and delight existing customers in an increasingly competitive marketplace.

In that respect, the outlook for marketing budgets is positive: 80% of manufacturers state they intend to maintain (27%) or increase (53%) their spend on marketing for 2022. Only 5% feel their marketing budget will decrease. As mentioned in the previous section of this report, digital is taking the lead with regard to where budget is placed. However, with the world opening back up and events starting to take place once again, only time will tell if more expensive offline marketing methods come back into play.

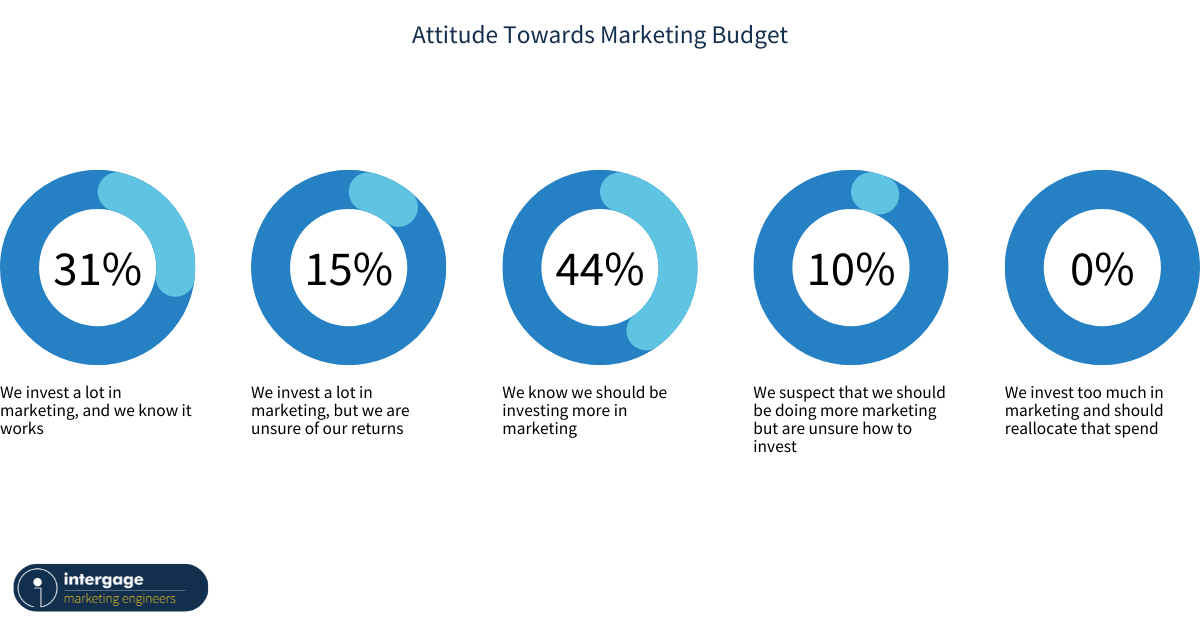

When it comes to how organisations feel about their marketing budget, there is an overriding sense that there should be more investment: 54% of manufacturers know or suspect they should be spending more on marketing with a further 15% stating they invest a lot but are unsure of their returns for the second year in a row, measuring success and return on investment has been featured in the top three marketing challenges for manufacturers.

.png?width=1200&name=Survey%20report%20charts%202022%20(15).png)

This is typical of the industry with many businesses suffering from long sales cycles and complex buying teams, making measuring success a challenge. When it comes to budget, this can start a vicious cycle as – to attain larger budgets – many industrial marketers need to prove that marketing yields results. This is often where investing in a high-quality tech stack including a CRM system, marketing automation and integrated website pays off – providing industrial marketers with the ability to measure campaigns from start to finish in a single system.

Despite the challenges manufacturing businesses are up against, the outlook on marketing budgets is positive and indicates the sector’s desire and need to grow.

How Do Manufacturers Measure Marketing?

If you can’t measure it, you can’t manage it. Measurement is crucial to any manufacturer that wants to grow their business. That includes measurement of raw materials, measurement of production line efficiencies and of course, manufacturing cycle time. Marketing is no different. Without measurement, you’ll have no idea:

- what’s working and what’s not

- what’s driving new business

- which initiatives provide the best ROI

- which initiatives help to boost customer lifetime value.

We wanted to understand how manufacturing businesses measure their marketing success and how this differed when compared with the last time we took a litmus test in 2021.

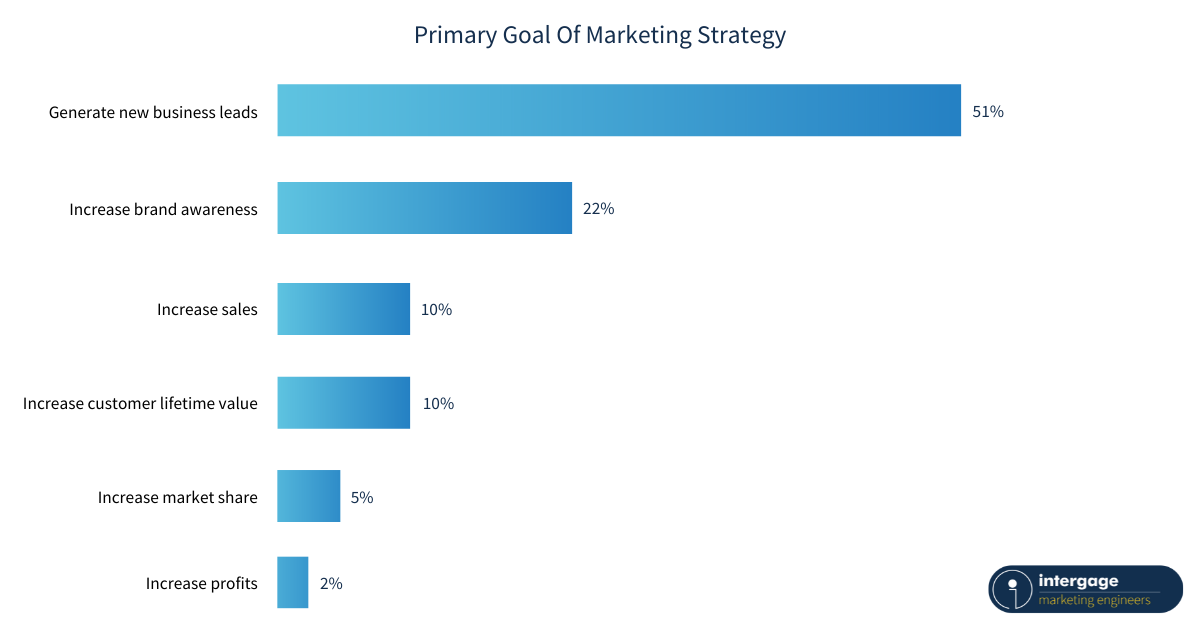

More than half (51%) of manufacturers said their primary marketing goal was to generate new business leads – a 13% increase on last year. This comes as fewer manufacturers aim for an increase in brand awareness and an increase in sales.

The disparity between ‘generate new leads’ and ‘increase sales’ suggests that too many manufacturers see their next big order coming from new customers over the horizon and not necessarily from the existing loyal clientele under their noses.

This is worrying: it suggests that some manufacturers are operating on ‘new business autopilot’. They see new clients as their most likely source of higher turnover, instead of:

- leveraging the opportunities offered by theirexisting customers to create more business

- revisiting their list of lost and lapsed clients to see if relationships can be profitably rekindled and business rejuvenated.

It is five to 25 times more cost-effective to retain an existing customer than it is to acquire a new one (Harvard Business Review, 8 April 2021).

Meanwhile, the need to increase brand awareness may be due to increased competition in existing markets – or the need to establish a presence in new territories due to:

- Saturation in existing markets, with little opportunity for further growth. This may explain why – worryingly – only 5% see increasing market share as a priority (no change from last year).

- The logistical challenges posed by the fallout after Brexit and the continuing Covid-19 pandemic.

Most worrying of all is the lack of focus on profit! The 2% ‘increase profit’ figure suggests a tactical – rather than strategic approach to business growth.

Increasing the profit margin enhances the successes of the salespeople when they exceed targets (and makes their lives a little more bearable when they don’t). It also gives the company more breathing space in tough times – such as those that manufacturers are likely to face this year.

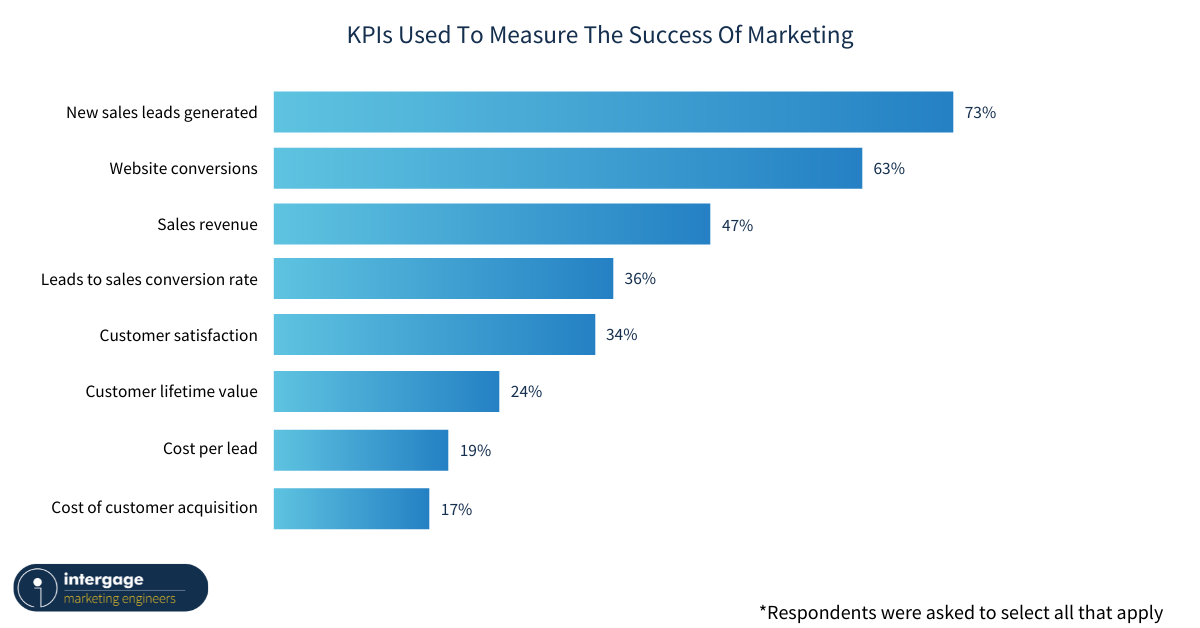

Looking at which KPIs manufacturers use to measure their marketing takes it one step further, giving us an insight into which metrics are considered important.

Similarly to last year, new sales leads generated and website conversions are the most popular metrics to measure marketing success. It’s easy to see why – these metrics are core to the sales process and provide hard evidence that a marketing campaign or initiative is working (providing of course that these leads are of a high quality).

However, only 47% list sales revenue as a KPI. Fewer still measure these vital KPIs:

- cost of customer acquisition – 17%

- cost per lead – 19%.

So few (36%) use the lead-to-sales conversion rate as a KPI. Manufacturers should delve deeply into the detail of their marketing data and review the conversion rates and ROI for each campaign or tactic – but alas, so many do not. They waste money, time and opportunities.

One such missed opportunity is Customer Lifetime Value: only 24% measure it as a KPI. Extending the time a customer remains loyal and encouraging them to spend more in that time will reduce the need to continually pour new business leads in at the top of the funnel.

And replacing that traditional sales funnel with a flywheel – in which happy customers become brand ambassadors – will help manufacturers to gain more from their existing client base.

But for that to become a reality, they will need to work much harder on monitoring customer satisfaction. Sadly, at present only 34% of manufacturers are doing this. The figure should be far higher: using simple but highly effective customer satisfaction monitoring tools such as Net Promoter Score (NPS) is a no-brainer.

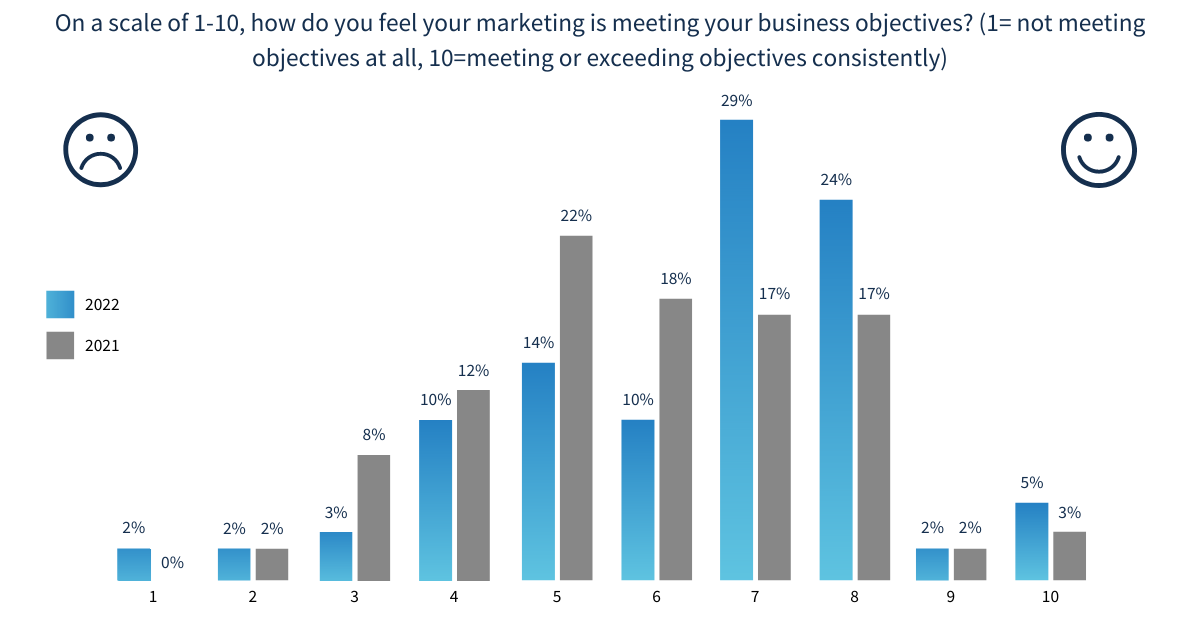

When it comes to how businesses are meeting objectives, we asked respondents to rate on a scale of 1 (not meeting objectives) to 10 (meeting or exceeding objectives consistently) how well they feel their marketing is performing.

The largest proportion of respondents (29%) rated their marketing success 7 out of 10, which is a marked improvement on last year’s majority rating marketing success at 5 out of 10. On top of that, 31% rate their marketing success at 5 or less, compared with 44% last year. This is matched with a 66% basis points in manufacturers feeling their marketing meets or exceeds their objectives consistently.

While these numbers are still small, they represent an improvement in marketing results and the feeling towards marketing across the industry.